[ad_1]

Bitcoin’s (BTC) price has the advantage of extremely bullish, highly enthusiastic investors who will never give up on the idea of a bull run.

This could be the factor that drives the cryptocurrency’s price up as investors look for profits.

Bitcoin Holders’ Bullishness – Optimism or Greed?

Bitcoin price has seen considerable influence from investors, where massive accumulation and dumping trigger a rise or decline. This is a good thing since, at the moment, the same momentum is rising, suggesting investors are bullish right now.

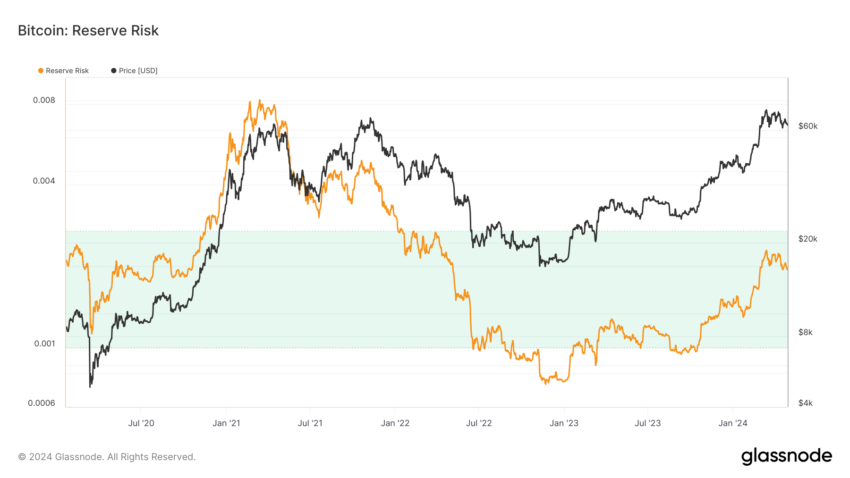

The Reserve Risk indicator is close to breaking out of the ideal green zone. This indicator is used to assess the confidence of long-term holders against the price of an asset. When the confidence is high and the price of an asset is low, there is an attractive risk/reward to invest in.

This is the case with BTC, as it is also exhibiting signs of being in an ideal zone for accumulation.

Read More: Bitcoin Halving History: Everything You Need To Know

The same indications can be seen in the Net Unrealized Profit/Loss (NUPL). This indicator in the Belief zone hints at a potential rally. Historically, BTC has noted growth in the past and even rallies when the indicator is in this zone, suggesting belief in the potential rally.

This could be the driving factor in the coming few days as well.

BTC Price Prediction: Rally to $95,000 on the Cards?

Bitcoin’s price at the time of writing is trading at $62,000, persisting above the $61,846 support floor. The recent rally followed by consolidation has resulted in the formation of a flag pattern.

The flag pattern is a technical analysis continuation pattern formed by a sharp price movement followed by a consolidation phase resembling a flag on a pole. It typically indicates a brief pause in a trend before the price resumes its previous direction.

In the case of Bitcoin, it will likely be an uptrend, and based on the target obtained by the pattern, BTC is expected to rally by more than 42%. If this rise is successful, the crypto asset could end up touching the highs of $95,000.

While a rally as massive as such is unlikely in the immediate future, the most probable increase could bring BTC to hit $80,000, marking a new all-time high.

Read More: Bitcoin Price Prediction 2024/2025/2030

However, if the cryptocurrency fails to breach the $71,800 resistance, it could fall back to $63,000. Further decline from this point would invalidate the bullish thesis, sending Bitcoin price to $61,000 and lower.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link

Be the first to comment