[ad_1]

Bitcoin mining is the cornerstone of the crypto industry and the crypto market. At its core, the profitability of mining comes down to a single, crucial metric — the cost of producing each bitcoin.

The importance of this cost becomes even greater when it comes to publicly traded Bitcoin mining companies, as it’s essentially what keeps them operational and ultimately profitable. In this report, CryptoSlate will focus on Marathon Digital and Riot Blockchain, two of the largest public Bitcoin miners.

Marathon Digital (MARA) and Riot Platforms (RIOT) are two of the largest public Bitcoin mining companies by market cap. Their operational capacity and financials offer important insights into the state of Bitcoin mining at its highest and most organized level.

While all public Bitcoin mining companies, including Marathon and Riot, provide data on their mining costs, there’s often more to the numbers they publish. Some companies use different accounting treatments for digital assets, which impacts their carrying value. Some companies have multiple mining sites across various geographical regions, each with different electricity prices and mining capacities.

To better understand the average cost to mine one bitcoin, CryptoSlate adopted an alternative approach — dividing the total costs of revenues for each company by the number of Bitcoins they produced. This method, albeit more speculative, promises a more telling reflection of actual mining costs.

Dividing the total costs of revenues by the number of Bitcoins produced provides a comprehensive view of the expenses incurred in the mining process. This approach goes beyond just the electricity or operational costs, including all direct and indirect costs associated with mining, such as equipment depreciation, maintenance, staffing, and administrative expenses.

By aggregating these costs, this method shows what it truly costs a company to mine each Bitcoin. It accurately reflects the economic reality, capturing the full spectrum of expenses that impact the bottom line. This helps us understand the efficiency and profitability of Bitcoin mining operations and is a valuable tool for analysts and investors seeking to understand mining companies’ financial health and operational efficacy.

Marathon Digital (MARA)

Marathon had a very successful 2023, expanding its operational capacity through acquisitions and new mining equipment. The company also announced that its acquisitions enabled it to decrease operational costs by as much as 30%, drastically influencing its profitability.

However, there’s little concrete information coming directly from Marathon about the company’s mining costs. A September analysis from Motley Fool put Marathon’s cost to mine 1 BTC at just under $19,000. The company’s latest monthly update for December 2023 only states the increases in hash rate capacity and technical details about its mining performance but contains no information about its mining costs.

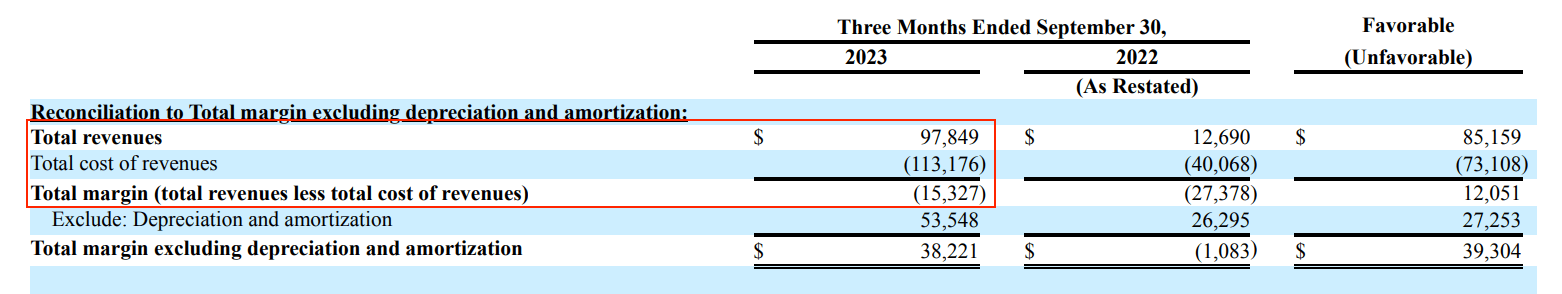

Our primary data source is the company’s 10-Q report for the third quarter of 2023. To determine the average cost of mining 1 BTC, we’ll employ the alternate method of dividing the total costs of revenues by the number of Bitcoins produced in the three months ending Sep. 30, 2023. Data from the report shows the total cost of revenues as $113.176 million. Subtracting the total margin from the cost of revenues puts it at $97.849 million.

With the company producing 3,490 BTC during the quarter, dividing the cost of revenues by the number of produced bitcoins brings us to a cost of mining of approximately $28,036.96.

Riot Platforms (RIOT)

Riot has spent the better part of 2023 implementing a long-term strategic plan to help the company stay profitable after Bitcoin’s halving in April 2024. In its update for the third quarter of 2023, the company’s CEO said its power strategy enabled it to reduce its YTD cost to mine to $5,537 per Bitcoin.

This extremely low cost can be attributed to Riot’s specific business strategy, which involved earning power credits from the Electric Reliability Council of Texas (ERCOT). Riot participates in ERCOT’s demand response program, which reduces electricity consumption during peak demand periods in exchange for power credits. These credits reduce Riot’s electricity costs, a major component of Bitcoin mining expenses.

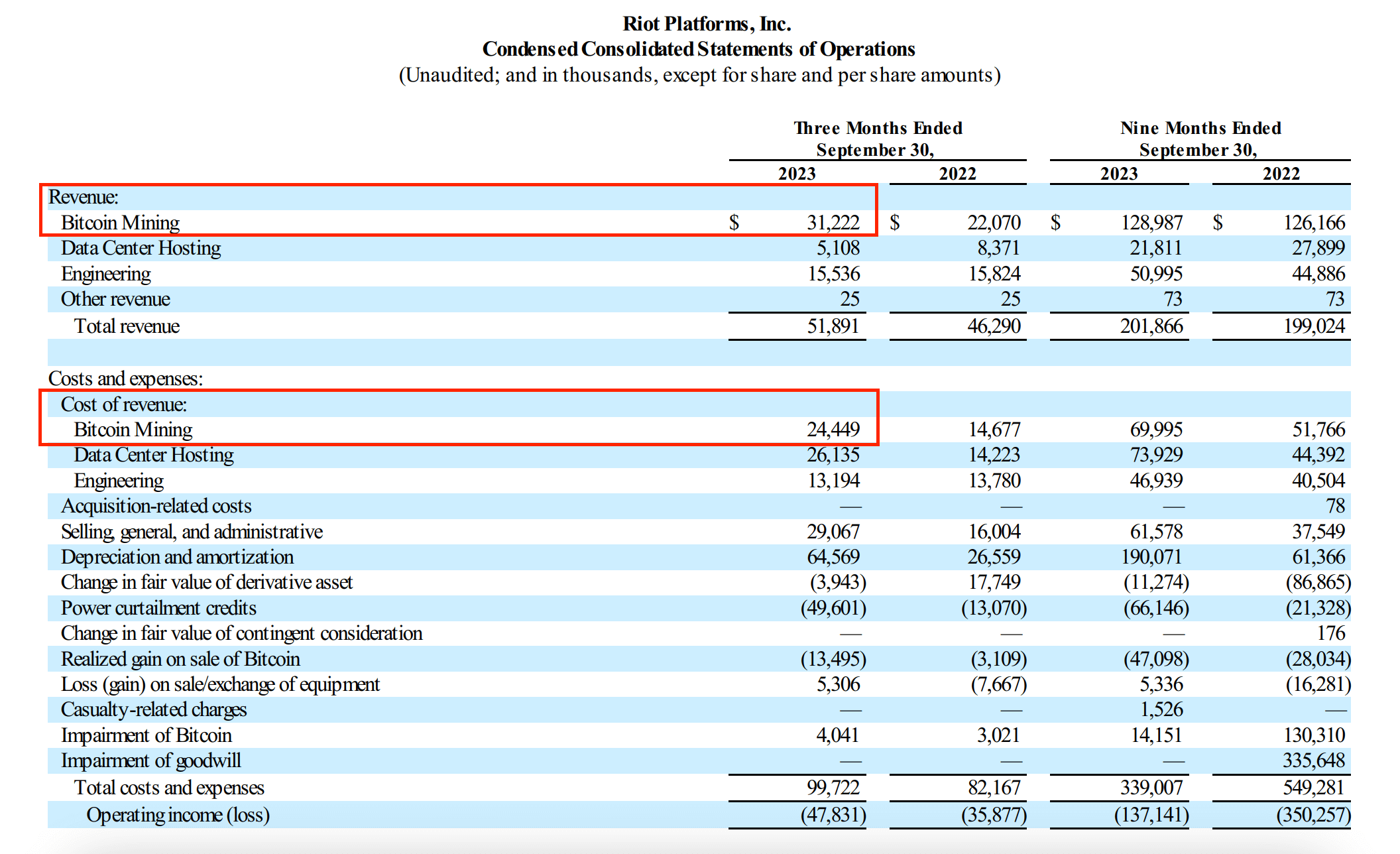

To get an average cost of mining one bitcoin for Riot, we’ll apply the same methodology to Marathon – dividing the cost of revenue by the number of bitcoins mined in a given period. According to Riot’s 10-Q filing for the third quarter of 2023, Riot’s cost of revenue for Bitcoin mining stood at $24.449 million. During this period, Riot mined 1,106 BTC.

By dividing the total cost of revenues specific to Bitcoin mining by the number of mined BTC, we find that Riot’s average cost for mining one Bitcoin in the third quarter was approximately $22,105.78.

This puts Riot’s cost for mining close to Marathon’s $28,036.96. However, a critical component of Riot’s operational strategy is its engagement with ERCOT. During the third quarter of last year, Riot received approximately $49.6 million in power curtailment credits from ERCOT.

According to its 10-Q filing, if the $49.6 million in power curtailment credits for the quarter were directly allocated to Bitcoin mining cost of revenue based on its proportional power consumption, it would decrease by $31.2 million. In this case, the adjusted cost of revenue would result in a negative value of -$6.751 million, showing that the credits would offset Riot’s original cost.

Given this data, the average cost to mine one bitcoin would be approximately -$6,105.78. While this is a highly unlikely scenario, it shows how substantial the impact of the power curtailment credits could be on Riot’s mining operation and how much it could contribute to overall profitability.

The post Marathon vs Riot: Analyzing the true cost of mining 1 bitcoin appeared first on CryptoSlate.

[ad_2]

Source link

Be the first to comment