Mastering Forex Trading: A Comprehensive Guide for Beginners

Welcome to the world of Forex trading, where opportunities await those who are willing to learn and adapt. If you’re eager to understand the dynamics of currency trading, you’ve come to the right place! This guide will help you navigate the complexities of the Forex market, providing you with the foundational knowledge needed to start trading. For quality trading support and resources, consider checking out learn forex trading Trading Broker ZA.

What is Forex Trading?

Forex trading, or foreign exchange trading, involves buying and selling currencies in the global market. It is the largest financial market in the world, where trillions of dollars are traded daily. Unlike stock trading, Forex operates 24 hours a day, five days a week, allowing traders to engage at any time that suits them.

Getting Started with Forex

Before diving into trading, it’s essential to understand some key concepts:

- Currency Pairs: Currencies are traded in pairs (e.g., EUR/USD), where one currency is bought while the other is sold.

- Leverage: Forex trading often involves leverage, allowing traders to control larger positions than their initial investment. However, leverage increases both potential profits and potential losses.

- Pips: A pip is a unit of measurement that represents the smallest price change in the Forex market. Understanding how pips work is crucial for calculating profit and loss.

- Spreads: The spread is the difference between the bid price and the ask price of a currency pair. It’s one of the costs you incur when trading.

Choosing a Trading Strategy

Once you have grasped the basics, the next step is to choose a trading strategy that fits your trading style and goals. Here are some common strategies:

- Day Trading: Involves entering and exiting trades within the same day to capitalize on short-term market movements.

- Swing Trading: Traders hold positions for several days or weeks, aiming to profit from anticipated price movements.

- Scalping: A strategy that involves making numerous trades throughout the day, benefiting from small price changes.

- Position Trading: Long-term strategy where traders hold positions for months or years, based on fundamental analysis.

Fundamental and Technical Analysis

To succeed in Forex trading, it’s crucial to understand both fundamental and technical analysis:

Fundamental Analysis

This approach involves analyzing economic indicators, news releases, and geopolitical events that can impact currency values. Key factors to consider include interest rates, inflation, employment data, and economic growth.

Technical Analysis

Technical analysis focuses on price charts and indicators to predict future price movements. Traders use patterns, trends, and various technical indicators (like moving averages and RSI) to make informed decisions.

Risk Management

Developing a solid risk management strategy is essential in Forex trading. Successful traders understand that losses are part of the game. Here are some tips for managing risk:

- Set Stop-Loss Orders: Use stop-loss orders to limit potential losses on trades.

- Employ Proper Position Sizing: Determine how much of your capital to risk on each trade based on your overall account balance.

- Diversify Your Portfolio: Avoid putting all your capital into one trade or currency pair.

- Emotion Control: Keep your emotions in check and stick to your trading plan, regardless of market fluctuations.

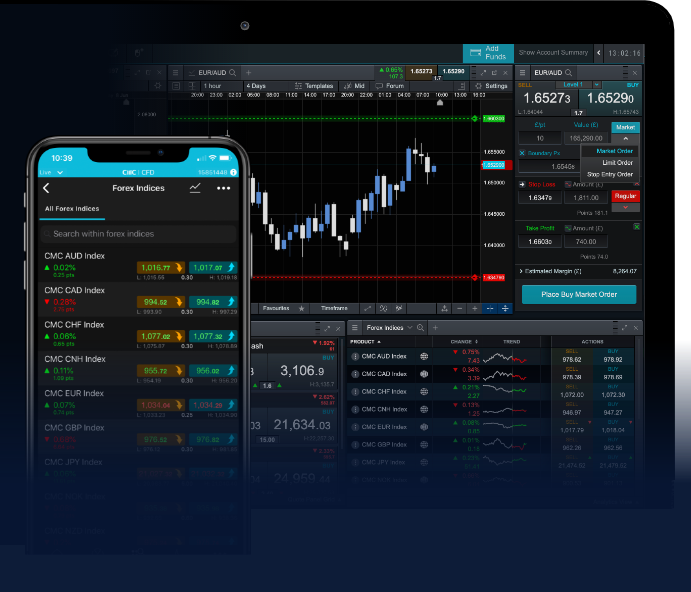

Finding a Reliable Broker

Choosing the right broker is critical for your Forex trading success. Look for factors such as:

- Regulation: Ensure the broker is regulated by a reputable authority to protect your investments.

- Trading Platform: Check for a user-friendly trading platform with the necessary tools and features like charting software and indicators.

- Customer Support: Reliable customer support can help you resolve issues quickly.

- Account Types: Different brokers offer various account types and conditions, so choose one that fits your needs.

Continuous Learning and Improvement

Forex trading is not a get-rich-quick scheme. It requires continuous learning, practice, and adaptation. Here are some resources to enhance your trading knowledge:

- Online Courses: Many websites offer free and paid courses tailored to different trading skills.

- Forex Books: Read books written by seasoned traders to gain insights and strategies.

- Forums and Communities: Engage with other traders in forums to share experiences and tips.

- Demo Accounts: Practice trading strategies without risking real money using demo accounts offered by brokers.

Conclusion

As you embark on your Forex trading journey, remember that success requires dedication, discipline, and a willingness to learn. By understanding the market dynamics, employing effective strategies, and managing risk, you can become a proficient Forex trader. Keep refining your skills, stay informed about market changes, and most importantly, enjoy the journey!

Happy trading!

Be the first to comment