[ad_1]

In a recent analysis of Compound Finance’s token distribution, Bubble Maps, a blockchain analytic platform on December 11, reveals that a16z, a crypto-focused venture capital firm, holds 11% of COMP’s total supply.

Bubble Maps notes that a significant stake held by a16z in Compound Finance’s governance model raises concerns over the protocol’s decentralization. A16z’s influence on proposals could outweigh the interests of the community.

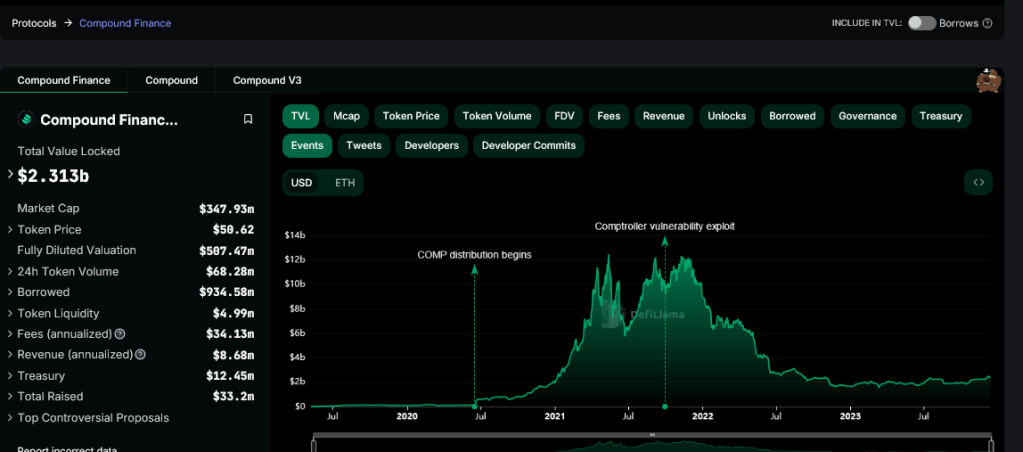

Compound Finance is a decentralized finance (DeFi) platform that allows users to lend and borrow various coins. According to DeFiLlama on December 11, the project has a total value locked (TVL) of $2.31 billion.

Its native ERC-20 token, COMP, is used for governance. As such, holders can vote on proposals that involve changes to the protocol’s core rules and parameters.

Venture Capital Firm, a16z, Controls 11% Of COMP’s Supply

However, Compound Finance was a decentralized crypto project, relying on a pool of retail and institutional investors, including venture capitalists, when raising funds in its formative stage. Because of this leeway, a16z and other crypto funds, including Bain Capital and Paradigm, are major investors.

As a result of these investments, Compound Finance, Bubble Maps said, distributed 24 million COMP to private investors, of which a16z initially received 1.34 million COMP. However, the fund has liquidated some over the years, dropping their total holdings to 1.1 million, or 11% of the total supply.

This concentration of power in the hands of a single entity raises concerns about the decentralization of Compound Finance. Decentralization is a core principle in blockchain, and since Compound Finance is a project running on public ledgers like Ethereum, it must ensure that a single entity doesn’t hold that much control.

If a16z were to use its majority stake in COMP to push through proposals that benefit its interests, it could effectively undermine the community’s power and compromise the protocol’s integrity.

As Bubble Maps observed, Compound Finance is especially susceptible to this, considering their vote quorum requirement is 4%. For a proposal to be effected, at least 4% of COMP holders must support the idea.

Is This A Risk For Compound Finance?

While this vote quorum requirement does provide some protection against the undue influence of a single entity, it is still possible for a16z to exert significant influence over the protocol by coordinating with other large COMP holders.

Moreover, the fact that a16z holds 11% of COMP’s token supply raises questions about the long-term sustainability of the protocol’s pro-DAO governance model. If a16z continues accumulating COMP in the open market, it could eventually reach a point where it can effectively dictate the protocol’s direction without coordinating with other holders.

Feature image from Canva, chart from TradingView

[ad_2]

Source link

Be the first to comment